Starters

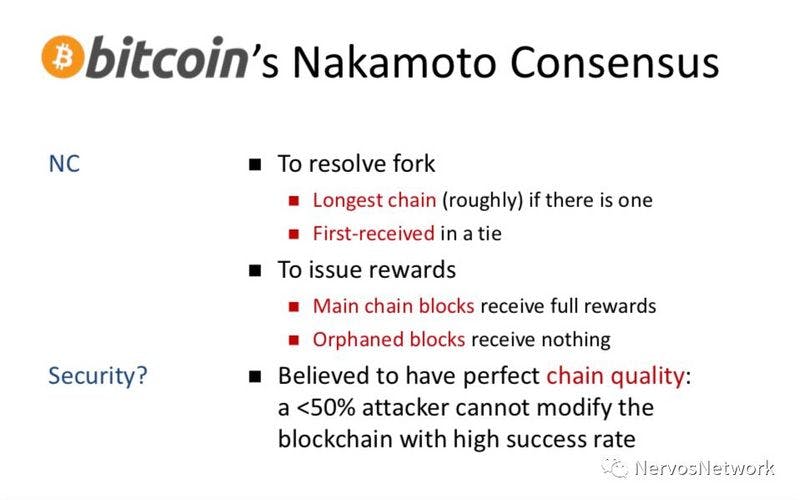

The most revolutionary thing about Bitcoin is the "Nakamoto Consensus". We all know that Bitcoin in itself is the most Advanced Practical use of Technology but this is also true that "Nakamoto stood on the shoulders of the Giants". The infamous Satoshi Nakamoto didn't solve all the pieces of the puzzle from scratch, he just happen to put the last piece in the right place at that moment and that piece of the puzzle is "Nakamoto Consensus". It is the invention and implementation of "The Nakamoto Consensus" that made Bitcoin truly decentralized and secure at the same time. So let's dive right into it.

Main Course

Nakamoto Consensus consists of 4 major parts:-

- Proof of Work (PoW)

- Block Selection

- Scarcity

- Incentive Structure

Proof of Work(PoW)

Miners compete to mine blocks in order to earn the block reward that is issued for each successfully mined and validated block. The cost of this mining process is electricity, which has a real-world financial value, thus giving the issued BTC for each mined block an inherent value. Contributing to mining is based on computational power, the more power within the network that you have, the more likely you are to mine a block. However, it is a lottery with a random chance of who will win, So it is impossible to know who will win the next round and the cost to participate will continue to increase. Because of this model, the longest chain is considered the valid chain because it came from the largest pool of computational power. With a massively distributed network like Bitcoin’s, the cost of attacking the network through a 51% attack is enormous and only grows larger as the network continues to grow.

Miners compete to mine blocks in order to earn the block reward that is issued for each successfully mined and validated block. The cost of this mining process is electricity, which has a real-world financial value, thus giving the issued BTC for each mined block an inherent value. Contributing to mining is based on computational power, the more power within the network that you have, the more likely you are to mine a block. However, it is a lottery with a random chance of who will win, So it is impossible to know who will win the next round and the cost to participate will continue to increase. Because of this model, the longest chain is considered the valid chain because it came from the largest pool of computational power. With a massively distributed network like Bitcoin’s, the cost of attacking the network through a 51% attack is enormous and only grows larger as the network continues to grow.

Block Selection

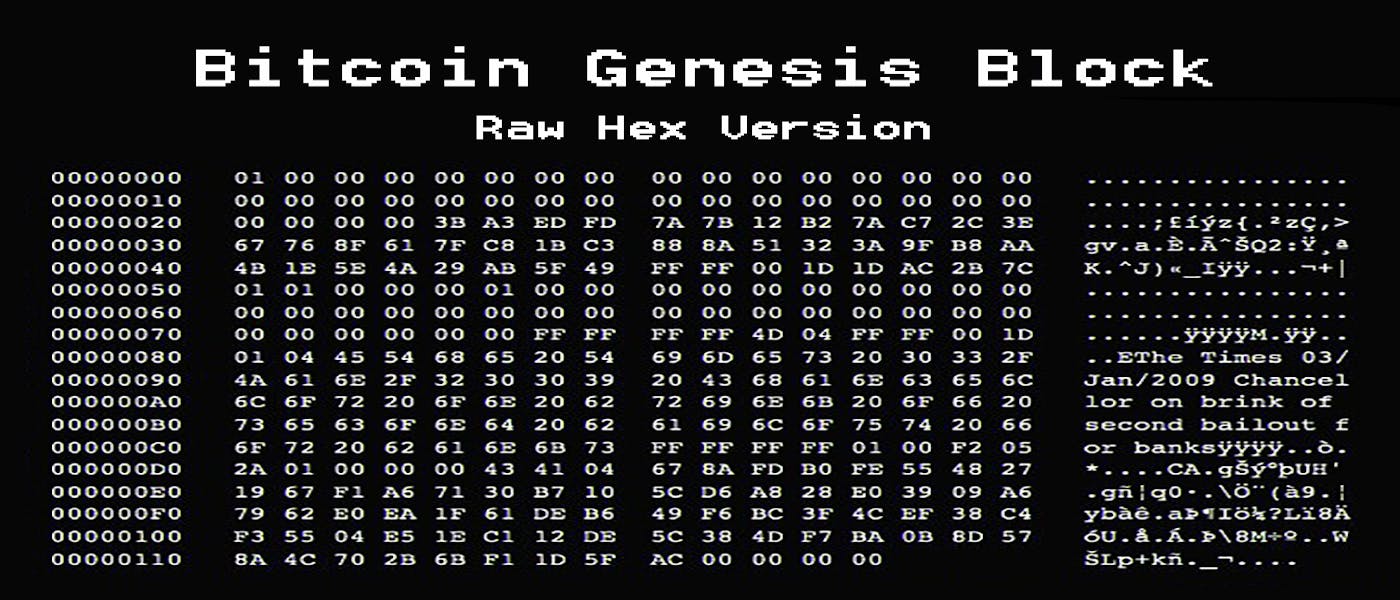

The block selection process refers to the “lottery” process for miners competing to win the block reward for mining the next block. Bitcoin utilizes a cryptographic puzzle predicated on incrementing a nonce in the block until the correct value that represents the block’s hash and required zero bits for the beginning of the nonce is reached. The miners compete to solve this puzzle and the first to find the solution wins the round of the lottery. Then block is propagated by the miner across the network to the other mining nodes who implicitly vote to accept the block as valid by adding the block to the longest chain. The only way to win the lottery is by contributing hashing power to the network in hopes of winning, and when you don’t win, the expended energy becomes a sunk cost, adding to the incentive structure of mining.

The block selection process refers to the “lottery” process for miners competing to win the block reward for mining the next block. Bitcoin utilizes a cryptographic puzzle predicated on incrementing a nonce in the block until the correct value that represents the block’s hash and required zero bits for the beginning of the nonce is reached. The miners compete to solve this puzzle and the first to find the solution wins the round of the lottery. Then block is propagated by the miner across the network to the other mining nodes who implicitly vote to accept the block as valid by adding the block to the longest chain. The only way to win the lottery is by contributing hashing power to the network in hopes of winning, and when you don’t win, the expended energy becomes a sunk cost, adding to the incentive structure of mining.

Scarcity

Scarcity in Bitcoin is based on this premise by limiting the total number of Bitcoin that will be mined to 21 million. Bitcoin can only be injected into the system through the mining process and it follows a deflationary scheme where the block reward is halved roughly every 4 years. Before inflationary currencies, precious metals were the main form of value storage and commerce. One of the primary reasons that they were used, and still retain their historical value (think gold and silver), is because they are scarce. Not only are they scarce, but it requires effort (PoW above) to mine them and use them.

Scarcity in Bitcoin is based on this premise by limiting the total number of Bitcoin that will be mined to 21 million. Bitcoin can only be injected into the system through the mining process and it follows a deflationary scheme where the block reward is halved roughly every 4 years. Before inflationary currencies, precious metals were the main form of value storage and commerce. One of the primary reasons that they were used, and still retain their historical value (think gold and silver), is because they are scarce. Not only are they scarce, but it requires effort (PoW above) to mine them and use them.

Incentive Structure

Miners are incentivized to validate and secure the network honestly, as the reward they receive for mining a block is Bitcoin. If the value of Bitcoin drops or the network becomes compromised, it affects their bottom line.

Miners are incentivized to validate and secure the network honestly, as the reward they receive for mining a block is Bitcoin. If the value of Bitcoin drops or the network becomes compromised, it affects their bottom line.

Conclusion

Bringing two or more unknown people into an agreement without any trust factor is what Bitcoin does thanks to Nakamoto Consensus.